MyPaymentVault

North Lane Technologies, Inc.

Installs

500K+

Developer

North Lane Technologies, Inc.

-

Category

Finance

-

Content Rating

Rated for 3+

Developer Email

Privacy Policy

https://login.northlane.com/xContent/content/op/program/privacy_cookies.html

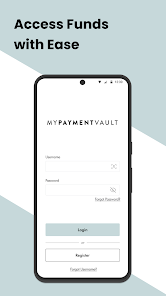

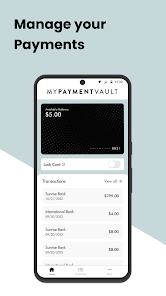

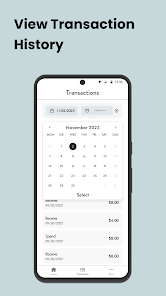

Screenshots

What's free, and what's not?

MyPaymentVault is free to download, making it accessible to anyone interested in managing their payments efficiently. You can easily download the app without any charges or fees. However, it's important to note that the app might include certain features or services that could require in-app purchases or subscriptions, enhancing your user experience but potentially adding some costs. Make sure to review any available premium features, as these may require extra payments.

The app may also present some advertisements within its interface, which contribute to maintaining its free-to-download status. If ads are present, users typically have options, such as subscribing to an ad-free experience. Reviewing the payment terms related to any advanced features or subscriptions can give you clarity on what, if any, additional costs might be involved.

How to set it up and get started

Installation on iOS Devices: MyPaymentVault supports iOS versions 11 and above. To install the app, visit the App Store on your iOS device, search for 'MyPaymentVault' and tap the download button. You may need to authenticate using your Apple ID password or Face ID. Once installed, open the app and grant the necessary permissions, such as access to contacts and notifications to fully utilize its features. Ensure to review any initial setup instructions and settings options provided within the app.

Installation on Android Devices: For Android users, MyPaymentVault is compatible with Android version 6.0 and later. Head to the Google Play Store, search for 'MyPaymentVault', and tap on 'Install.' Permission requests may include access to storage and network connections. It's recommended to review these permissions and enable notifications if desired, as it enhances the app's functionality. After installation, check the app's settings for any initial setups or configuration options that align with your preferences.

How This App Works?

Step 1: Begin by launching the MyPaymentVault app after installation. The user interface is designed to be intuitive, featuring clearly marked sections for easy navigation. Upon first opening, you might be prompted to create an account or log in using existing credentials, providing a secure environment for managing your payments.

Step 2: Once logged in, explore the dashboard. Here, you'll find various options such as setting up payment methods, tracking expenses, and analyzing transaction history. Icons and toolbars are typically categorized for straightforward access to features like linking bank accounts or managing saved payment methods.

Step 3: If setting up new payment methods, navigate to the 'Manage Payments' section. Follow the guided steps provided, entering necessary information and verifying your details. This section ensures that you have a comprehensive overview of all your active and inactive payment options.

Step 4: Utilize the app's 'Analytics' feature to monitor your spending and budget efficiently. This tool provides insights and graphs, helping you better understand your spending habits and make informed decisions.

Step 5: Lastly, customize notifications within the settings tab. Setting alerts for transaction activities, payment deadlines, or budget limits can optimize your experience, ensuring you are always informed regarding your finances.

Practical Advice For Better Use

Tip 1: Take advantage of MyPaymentVault's automatic categorization feature. This helps streamline your expense tracking by sorting transactions into categories such as 'Food', 'Travel', and 'Utilities'. It's an efficient way to see where you're spending the most and adjust your budget accordingly.

Tip 2: Regularly review and update your saved payment methods to prevent any failed transactions or expired card issues. By actively managing these settings, you can ensure a smoother transaction process every time.

Tip 3: For better financial oversight, enable the app's report generation feature. These reports can be sent directly to your email or accessed within the app. It's a useful option for compiling monthly or quarterly financial statements, helping with both personal finance management and preparing for potential audits.

Recommended Apps

![]()

U: TV Series Stream on Demand

UKTV Media Ltd3.7![]()

PDF Scanner - Document Scanner

Tools & Utilities Apps4.8![]()

PhotoTune - AI Photo Enhancer

Vyro AI4.5![]()

The RealReal

The RealReal0![]()

Lemon8 - Lifestyle Community

Heliophilia Pte. Ltd.4.9![]()

Coast To Coast AM Insider

Premiere Radio Networks, Inc.4![]()

FanFiction.Net

FictionPress3.2![]()

Idol Prank Call & Chat Prank

WELLY GLOBAL PUBLISHING4.2![]()

Extra Volume Booster Equalizer

Magic Mobile Studio4.7![]()

Italo: Italian Highspeed Train

Italo S.p.A.4.7![]()

Simple Speedcheck

Internet Speed Test, Etrality4.7![]()

Beats

Apple3.7![]()

Habit Tracker

App Holdings4.4![]()

Private Photo Vault - Keepsafe

Keepsafe4.5![]()

myBuick

General Motors (GM)4.5

You May Like

-

![]()

TP-Link Deco

TP-LINK GLOBAL INC.4.6 -

![]()

mysms - Remote Text Messages

mysms - SMS App - SMS Texting from Computer4 -

![]()

Cookpad: Find & Share Recipes

Cookpad Inc (UK)4.7 -

![]()

Pushbullet: SMS on PC and more

Pushbullet4.4 -

![]()

HD Camera with Beauty Camera

Coocent4.6 -

![]()

USA Weather forecast

ID Mobile SA0 -

![]()

Mobizen Screen Recorder for LG

MOBIZEN4.2 -

![]()

Screen Mirroring - TV Miracast

Studiosoolter4.1 -

![]()

AMN Passport: Healthcare Jobs

AMN Healthcare Inc3.9 -

![]()

LG ThinQ

LG Electronics, Inc.4.5 -

![]()

NBA: Live Games & Scores

NBA Properties, Inc.4 -

![]()

Master for Minecraft Mods

Addons and Mods for Minecraft4 -

![]()

Spark Driver

Walmart3.9 -

![]()

KeepSolid VPN Unlimited

KeepSolid Inc4.2 -

![]()

Photo Collage Maker, Editor

GAM Mobile App4.2

Disclaimer

1.Allofapk does not represent any developer, nor is it the developer of any App or game.

2.Allofapk provide custom reviews of Apps written by our own reviewers, and detailed information of these Apps, such as developer contacts, ratings and screenshots.

3.All trademarks, registered trademarks, product names and company names or logos appearing on the site are the property of their respective owners.

4. Allofapk abides by the federal Digital Millennium Copyright Act (DMCA) by responding to notices of alleged infringement that complies with the DMCA and other applicable laws.

5.If you are the owner or copyright representative and want to delete your information, please contact us [email protected].

6.All the information on this website is strictly observed all the terms and conditions of Google Ads Advertising policies and Google Unwanted Software policy .